Changing Pension Schemes

This guide shows the steps you must take in Payroll Manager to move an employee(s) from one pension scheme to another.

1. Cease employee / employer contributions to the ‘old’ pension scheme:

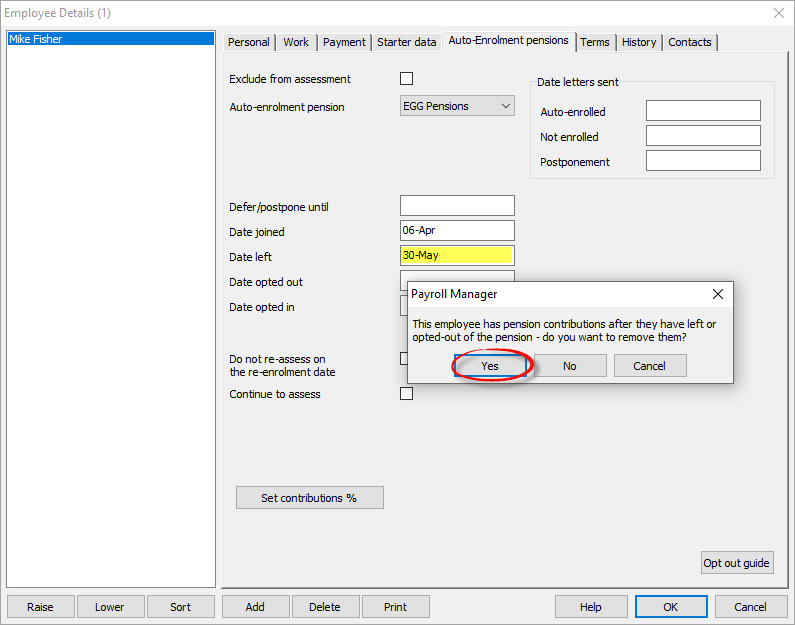

– From the main menu in Payroll Manager, click ‘Employees‘ then ‘Employee Details‘, then click on the ‘Auto-Enrolment pensions‘ tab, and select the relevant employee.

– Enter a date into the ‘Date left‘ field. This should be the last date that you wish contributions to be made for that particular pension scheme. The software will identify if there are pension contributions/percentages entered after this date, and will offer to remove them. Answer ‘Yes‘ when prompted to do so, then click ‘OK‘. Repeat this process for each applicable employee.

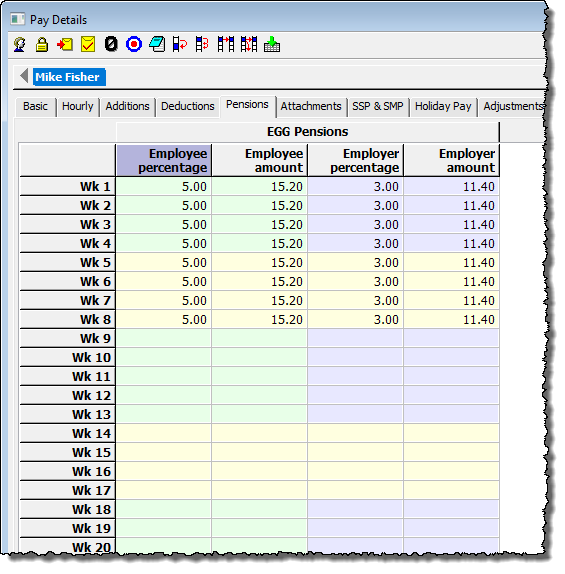

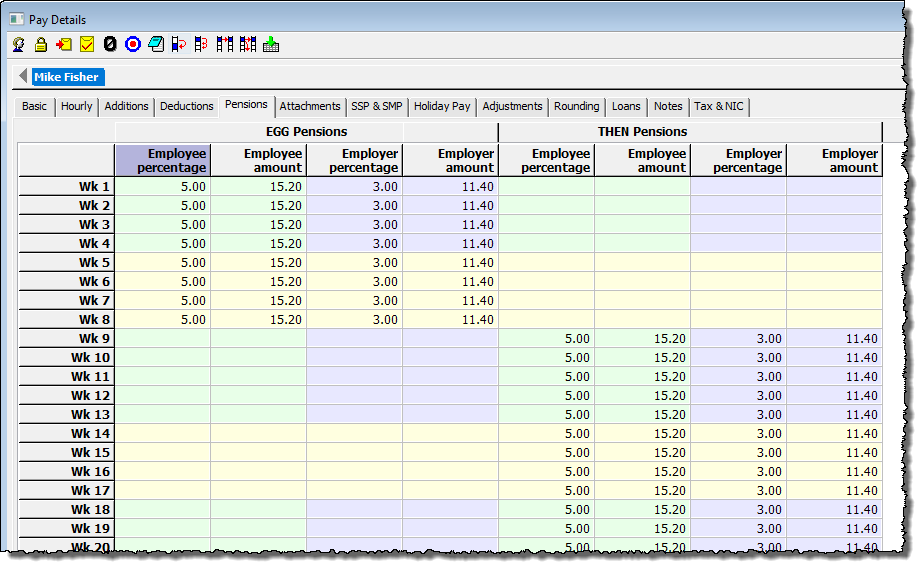

– Go to the ‘Pay Details‘ screen, click on the ‘Pensions‘ tab and check that contributions/percentages cease in the correct pay period (e.g. below). Make manual adjustments on this screen if necessary.

2. Report the final contributions to the ‘old’ pension scheme

It is very important that you finish everything that you need to do with regards to reporting /uploading the final pension contribution details to the ‘old’ pension scheme, before proceeding to step 3 of this guide.

3. Add details of the ‘new’ pension scheme to Payroll Manager

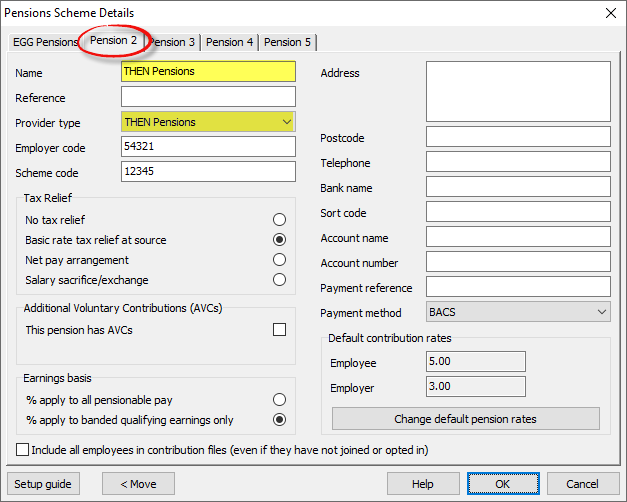

If you have not already set up the details of the new pension scheme then click ‘Pensions‘ then ‘Pension scheme details‘ from the main menu in Payroll Manager.

– Click on the next available unused tab along the top of the screen (in this example, the tab marked ‘Pension 2’), and proceed to enter the details of the ‘new’ pension scheme. We have specific guides which help with this – see Pension Set Up Guides for more details. Click ‘OK‘ when you have finished.

4. Add employee to new pension scheme and set contributions

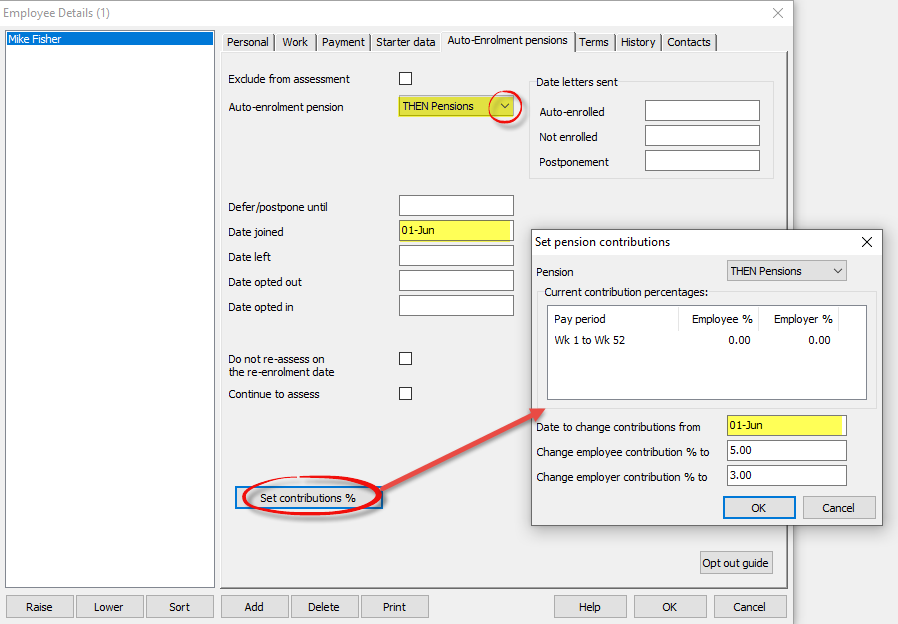

– Click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, then click on the ‘Auto-Enrolment pensions‘ tab, and select the relevant employee.

– Select the new ‘Auto-enrolment pension’ from the drop-down selector.

– Remove any dates that are currently entered in the ‘Date joined’, ‘Date left’, ‘Date opted out’ and ‘Date opted in’ fields (which are those which were applicable to the ‘old’ pension scheme). Do not edit or remove any dates that are entered in the ‘Date letters sent’ section at the top-right of the screen.

– Enter a new ‘Date joined‘ (which is the date from which you wish contributions to be made to the new pension scheme), then click on the ‘Set contributions %‘ button to set the relevant contribution percentages. Click ‘OK‘ and ‘OK‘ again when you have finished, and repeat this process for each applicable employee.

Go to the ‘Pay Details‘ screen, then click on the ‘Pensions‘ tab to check that the percentages have been entered correctly.

You will now be able to produce ‘upload files’ (enrolment and/or contribution files) for the new pension scheme.