Changing from one business to another

(e.g. sole trader to ltd company, or company A to company B), or when one business takes over another.

1. I have Payroll Manager 20 and need to change my company (e.g. changing from sole trader to ltd company or similar)

If your organisation is changing (e.g. from a sole trader to a limited company) and HMRC have issued a new PAYE reference, then follow the steps below:

a) You will need to complete everything for the old employer first:

- Enter a leaving date for each employee in the ‘work’ section of the Employee Details screen.

- File the FPS that contains the employee leaving information to HMRC

- Print off a P45 for each employee.

- On the menu click on Employer then Employer Details and enter the ‘Date PAYE scheme ceased’ on that screen.

- Send your final RTI return (an EPS).

b) When you have done all this then you need to re-register the program to the new company:

- Click on the menu on Help and then User Licence and on the box that appears click on the Enter a New User Licence Code button.

- Do NOT enter a new code – simply press Enter – you will then be prompted to enter the company name.

- When you have entered the name press OK on all the boxes, then shut down and re-start the program.

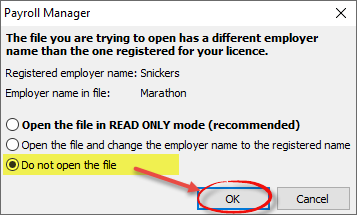

- Payroll Manager will display as message pointing out that the name of the file and that of the registered employer no longer match, and will ask how you wish to proceed. Select the option ‘Do not open the file‘ and click ‘OK‘

c) Next you need to create a new file for the new employer:

- Click on the menu of File and New and then Create a New Blank File, on the next box make sure it is set to the correct year, then press ‘OK’.

- Click ‘OK’ to save the file, then answer the questions about the NIC allowance and pay dates before proceeding to the next step.

d) Next you need to import all the names & addresses from the old file:

- Click on Tools and Import Data and then Import from Another Payroll Manager File.

- Select the file that you wish to import the data from.

- On the next screen un-tick the tick box at the bottom left labelled Import Pay Details.

- Click the Import All button to the right of the list of employees, then press OK.

e) Next add the employer details:

- Click on Employer Details and enter the details of the new company, e.g. the PAYE tax office/reference. Make sure that you complete the ‘Date PAYE scheme started’ field.

f) Finally you need to make all the employees join the new company:

- Go to Employee Details and on the work tab remove the leaving dates which were imported from the old file, and enter a start date for each employee as well.

- On the Starter Data tab, tick the Starter with P45 box, and enter the details of the P45s from the old employer. The Starter Data will be sent automatically as part of your next regular RTI submission.

2. I have Payroll Manager 100 or 250 and need to change my company (e.g. changing from sole trader to ltd company or similar)

If your organisation is changing (e.g. from a sole trader to a limited company) and HMRC have issued a new PAYE reference, then follow the steps below:

a) You will need to complete everything for the old employer first:

- Enter a leaving date for each employee in the ‘work’ section of the Employee Details screen.

- File the FPS that contains the employee leaving information to HMRC

- Print off a P45 for each employee.

- On the menu click on Employer then Employer Details and enter the ‘Date PAYE scheme ceased’ on that screen.

- Send your final RTI return (an EPS).

b) Create a new file for the new employer:

- Click on the menu of File and New and then Create a New Blank File. Enter the New Company name and the correct year, then press ‘OK’.

- Click ‘OK’ to save the file, then answer the questions about the NIC allowance and pay dates before proceeding to the next step.

c) Next you need to import all the names & addresses from the old file:

- Click on Tools and Import Data and then Import from Another Payroll Manager File.

- Select the file that you wish to import the data from.

- On the next screen un-tick the tick box at the bottom left labelled Import Pay Details.

- Click the Import All button to the right of the list of employees, then press OK.

d) Next add the employer details:

- Click on Employer Details and enter the details of the new company, e.g. the PAYE tax office/reference. Make sure that you complete the ‘Date PAYE scheme started’ field.

e) Finally you need to make all the employees join the new company:

- Go to Employee Details and on the work tab remove the leaving dates which were imported from the old file, and enter a start date for each employee as well.

- On the Starter Data tab, tick the Starter with P45 box, and enter the details of the P45s from the old employer. The Starter Data will be sent automatically as part of your next regular RTI submission.