Car benefits – Data Input & Calculation 2024-25

This guide explains how to enter details of company cars provided to employees during the tax year 2024-25 and shows how the benefit of such cars are calculated. If you are calculating benefits for a car provided in tax year 2025-26 then you should refer to our guide Car benefits – Data Input and Calculation 2025-26 instead.

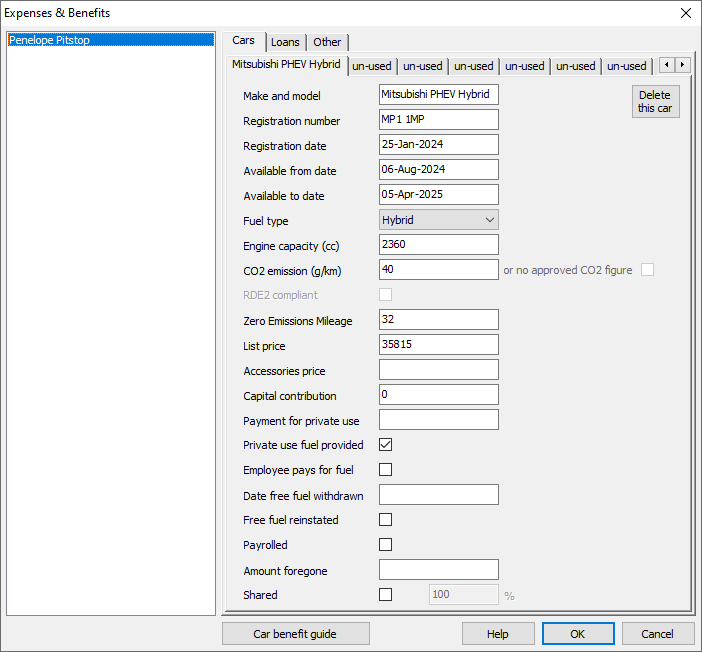

1. Entering details of the car

– Click ‘Employees’ then ‘Expenses & Benefits’ from the main menu and select the relevant employee.

– Click on the ‘Cars’ tab along the top of the screen, and then click on the first tab marked ‘un-used’ and enter details as follows:

- Make and Model – Enter the make and model of the car.

- Registration number – Enter the registration number of the car.

- Registration date – Enter the date on which the car was first registered. It is very important to make sure that this date is complete and accurate as it is one of the factors that affects the car benefit calculation. The registration date can be found on the Vehicle Registration Document (V5) or Vehicle Registration Certificate (V5C) for that car.

- Available from date – Enter the date that the car was first made available to the employee. You must leave this field blank if the car was available from before the start of the tax year.

- Available to date – If the car has been withdrawn from the employee then enter the last date that the car was available to them. You must leave this field blank if the car is still available to the employee after the end of the tax year.

- Fuel Type – Select one of Petrol, Diesel, Hybrid or Fully Electric from the drop-down list.

- Engine capacity (cc) – If the car was registered before Jan 1998, or if it is a petrol or diesel powered car without an ‘approved CO2 figure‘ then enter the engine size here, otherwise leave this field blank.

- CO2 emission (g/km) – For petrol, diesel or hybrid cars, enter the approved CO2 emissions figure as shown on the Vehicle Registration Document (V5) or Vehicle Registration Certificate (V5C) for that car. The Government VCA website can help you find the correct CO2 figure if you do not have the relevant documents. A very small number of cars with combustion engines have ‘no approved CO2 figure‘, in which case you would leave this field blank and instead tick the box marked ‘no approved CO2 figure’. Fully electric cars have an approved CO2 value of ‘0’.

- RDE2 Compliant (Diesel cars only) – If the car is a diesel car which meets the Real Driving Emissions 2 standard (RDE2) (also known as the Euro Standard 6d emissions standard) then tick this box. This is a new standard which has been recently introduced and as such many diesel cars do not currently meet this standard. You should check with the car manufacturer if you are unsure.

- Zero Emissions Mileage – For hybrid cars with CO2 in the range 1-50g/km you should provide the ‘Zero Emissions Mileage’ figure. This is the maximum distance in miles that the car can be driven in electric mode without charging the battery, and is available from the manufacturer.

- List price – Enter the list price of the car. For a full definition of what is meant by ‘list price’ please refer to Chapter 12 of HMRC 480: Expenses & Benefits Guide.

- Accessories price – Enter the total price of all accessories (if any), otherwise leave this field blank. Again, refer to Chapter 12 of HMRC 480: Expenses & Benefits Guide for further details.

- Capital contribution – If the employee has made a contribution towards the purchase of the car (or any accessories) then enter the total amount here, otherwise leave this field blank.

- Payment for private use – If the employee makes payments for private use of the car then enter the total amount here, otherwise leave this field blank.

- Private use fuel provided – If the employee is provided with fuel (petrol or diesel) for private use then tick this box, otherwise leave this box unticked. Ticking the box means that a fuel benefit charge will be calculated. Electricity does NOT count as fuel, so leave this box unticked for fully electric cars.

- Employee pays for fuel – If the employee covers all of the private costs of fuel personally then tick this box, otherwise leave the box unticked. Ticking the box has the effect of reducing the fuel benefit charge to nil.

- Date free fuel withdrawn – If the employee ceases to be provided with free fuel during the tax year then enter the relevant date here, otherwise leave this field blank.

- Free fuel reinstated – If the employee is provided with free fuel again (after having it withdrawn) then tick this box, otherwise leave the box unticked.

- Payrolled – If you have chosen to ‘Payroll’ this benefit in kind (PBIK) then tick this box, otherwise leave it blank. For more information on payrolling of benefits see our PBIK guide.

- Amount forgeone and Longer Transitional Protection period– These boxes are only used if the car is being provided to the employee in conjunction with an ‘Optional Remuneration Arrangement’ (OpRA), for example a salary sacrifice. You should leave these boxes empty unless such arrangements apply, in which case please refer to section 6 of this guide( ”Optional Remuneration Arrangements”) for further details.

- Shared – Leave this box unticked unless the car is shared between two or more employees. HMRC guide EIM25200 gives more information on shared cars.

– Click ‘OK’ when you have finished entering the car details

2. Calculating the Car Benefit

The rules for calculating the car benefit as specified by HMRC are as follows: (Payroll Manager performs these calculations automatically according to the data entered above).

- Take the list price of the car.

- Add the price of any accessories.

- Make deductions for capital contributions made by the employee (if any).

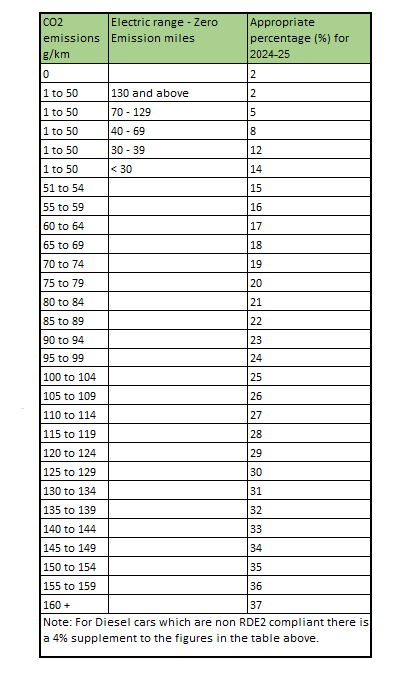

- Find the ‘appropriate percentage’ for the car (see Appendix at the bottom of this guide).

- Multiply the appropriate percentage by the net price of the car.

- Make any deductions for periods for which the car was unavailable (if any).

- Make any deductions for payments made by employee for private use (if any).

The result of this calculation gives the total benefit of the car.

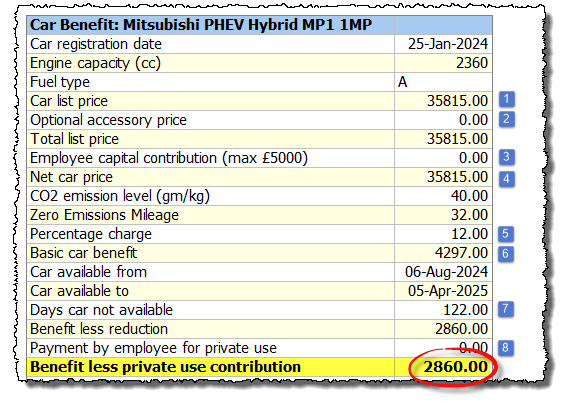

To see a breakdown of the calculation click ‘Analysis and then ‘Expenses & Benefits Calculation’ from the main menu in Payroll Manager. Select the appropriate employee and click ‘OK’.

In the example above:

- The list price is £35,815.

- The price of accessories is £0, so the total price is £35,815

- The employee has not made capital contributions towards the purchase of the car (0.00).

- The net price is calculated as £35,815 – £0.00 = £35,815

- The appropriate percentage for the car is 12% (for 2024-25). The appropriate percentage is determined by the registration date of the car, its fuel type and the level of CO2 emissions. Payroll Manager has these rules built in, and is able to calculate the correct percentage automatically. The Appendix at the bottom of this guide shows a table of percentage charges. Please note that there is a 4% supplement for diesel powered vehicles (unless they meet the new RDE2 standard, as described above). If the calculated percentage is not as you expected then please check the input for each of these fields. If you (incorrectly) leave the ‘Registration date’ field blank then Payroll Manager will assume that the car was first registered before 1 Jan 1998 and will calculate the appropriate percentage accordingly.

- The car benefit for the whole year is therefore £35,815 x 12% = £4,297.

- The car was available from 6 August 2024 until the end of the tax year. It was therefore unavailable for the first 122 days of the tax year (Payroll Manager calculates this automatically, based on the ‘available from’ and ‘available to’ dates). A deduction is made for the days that the car was unavailable as follows: £4,297 x 122/365 = £1,437, so the benefit after making deductions for unavailable days is £4,297 – £1,437 = £2,860.

- The employee has not made payments for private use of the car (0.00), so the car benefit is calculated as £2,860 – £0.00 = £2,860.

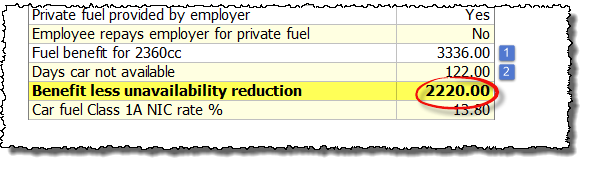

3. Calculating the Fuel benefit

If the employee is also provided with fuel then Payroll Manager will calculate the fuel benefit as follows:

- Multiply the appropriate percentage (the same percentage as for the car benefit calculation above) by a fixed sum as known as the ‘Car fuel benefit charge multiplier’ as specified by HMRC each year (see Chapter 13 of HMRC 480: Expenses & Benefits Guide). The multiplier in this example is £27,800 ). The fuel benefit for the whole year is therefore £27,800 x 12% = £3,336.

- As in the car benefit calculation (above), a reduction is made for days that the fuel was unavailable (122 days) giving a resulting fuel benefit of £2,220.

4. Reporting Expenses and Benefits to HMRC

Car benefits are reported to HMRC via the P11d following the end of the tax year. To see details of the P11d click ‘Forms’ then ‘Expenses & Benefits P11d’ from the main menu in Payroll Manager. In addition to this, you should inform HMRC about any changes that affect an employee’s car benefits (e.g. they have been issued with a new car, or have had a previous car replaced or withdrawn) by submitting a P46(Car) return online at that time. Click ‘Forms’ then ‘Car Change Notification P46(Car)’ from the main menu in Payroll Manager to do this.

Important: If you have chosen to use the new HMRC service for ‘payrolling’ car benefits (PBIK) then you should NOT submit a P11d or P46Car in respect of cars for that employee. See our PBIK guide for more details.

5. Class 1A NIC

Cars provided to employees as a benefit also generate a liability of employers class 1A National Insurance which must be paid to HMRC by 22 July following the relevant tax year. See HMRC guide Pay employers’ Class 1A National Insurance’ for more details. You should also file return P11D(b) to HMRC which is a summary of these liabilities. Click ‘Forms’ then ‘Employer’s Declaration P11D(b)’ to view and file this return.

6. Optional Remuneration Arrangements (OpRA)

Some employers use Optional Remuneration Arrangements (OpRA) such as ‘Salary Sacrifice’ to provide benefits to their employees. From April 2017 new rules were introduced so that the taxable value of a Benefit in Kind (BIK) is now the higher of the taxable value of that BIK under the ‘normal’ rules and the amount of salary/cash foregone. If you are using OpRA to provide a car to an employee then please read Appendix 12 HMRC 480: Expenses and Benefits Guide before completing your P11ds. In these circumstances you should enter the ‘amount foregone’ in the relevant box as shown in section 1 of this guide.

APPENDIX

The table of appropriate percentages for 2024-25 is shown below.

FAQs

What about electric cars? – Most ‘electric’ cars, either ‘hybrids’ or 100% electric will still have an ‘approved CO2’ figure associated with them. In the case of cars which are 100% electric the CO2 figure will be ‘0’ This should be entered in the ‘CO2 emission (g/km)’ box. The Government VCA website gives the appropriate figure for all cars.