Real Time Information ( RTI )

Under the new RTI payroll system employers will send information about the tax and national insurance that they deduct from employees' wages to HMRC at the time when they are deducted - rather than at the end of the tax year in April-May, as happens now. So instead of submitting this data once a year to HMRC, online submissions will be made weekly, fortnightly, four weekly or monthly, depending on the frequency at which their employees are paid. Employers will still calculate Tax & NIC (using their Moneysoft Payroll Manager software) in the normal way.

Our Payroll Manager software is being updated with all of the relevant functions and features to allow you to send your RTI returns efficiently and on time. These features will be added as part of the normal updating process during the coming months, so there will be no additional software costs in order for you to be able to operate RTI.

The screenshots below show some of the new screens that you will be using for RTI. (Please note that the exact layout of these screens may change over the coming months following feedback from our pilot RTI volunteers).

( This document is also available in pdf format ![]() for ease of printing )

for ease of printing )

What information does Payroll Manager need to send?

There are a number of different RTI submission types, the 'main' ones being the Full Payment Submission - (FPS) and the Employers Payment Summary - (EPS). Other submission types are covered in the FAQ section at the bottom of this page.

Full Payment Submission (FPS)

- The FPS is the 'main' submission type, and is sent each time that an employer pays their employees. So if employees are paid monthly you send 12 FPS submissions per year, if employees are paid weekly you send 52 FPS submissions and so on.

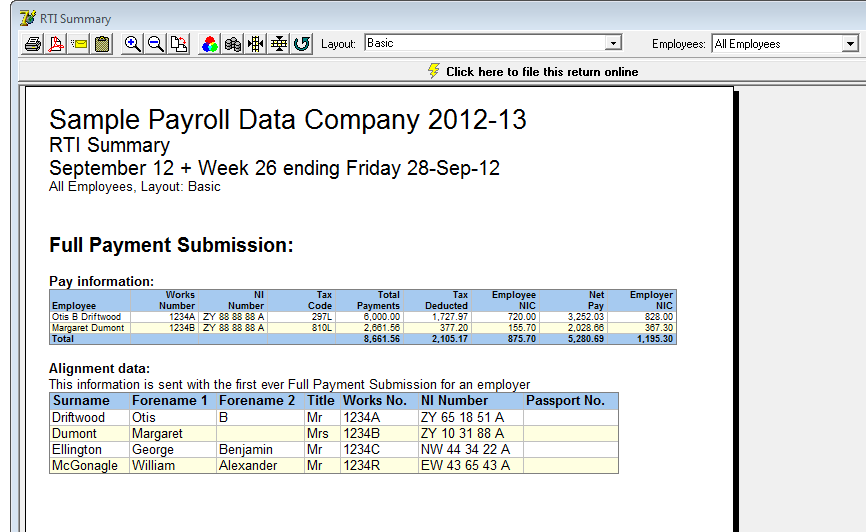

- The FPS contains details of all employees that are being paid in that particular pay period, and includes details such as their tax code, gross pay, tax deducted, NIC, sick pay (SSP), student loans and parenting pay (SMP, OSPP, ASPP etc.) together with their year-to-date figures.

- Each FPS also contains details of employees that have joined or left since the previous pay period, which means that P45s and P46s are no longer sent to HMRC. (A paper copy of the leaving P45 should still be issued to the employee themselves).

- The first FPS that an employer sends also serves as what is called the 'alignment' submission, and contains details of all employees that have been with the employer since the start of the tax year, regardless of whether or not they have been paid, or have since ceased their employment. This alignment process allows HMRC to verify that they have the correct details held on file for each employee (e.g. National Insurance Number, date of birth etc.)

Employers Payment Summary (EPS)

- If during any one PAYE month an employer has made any statutory payments to employees (Sick Pay, Maternity pay etc.), or has suffered any CIS deductions, or has not had the need to deduct tax or NIC from any of its employees (for example, it may not have paid anyone), then this information is reported to HMRC via the Employers Payment Summary (EPS) submission.

- Moneysoft Payroll Manager is able to determine whether or not an EPS is due, and if so sends this automatically alongside the relevant FPS submission.

How will I know what submissions I should send and when to send them?

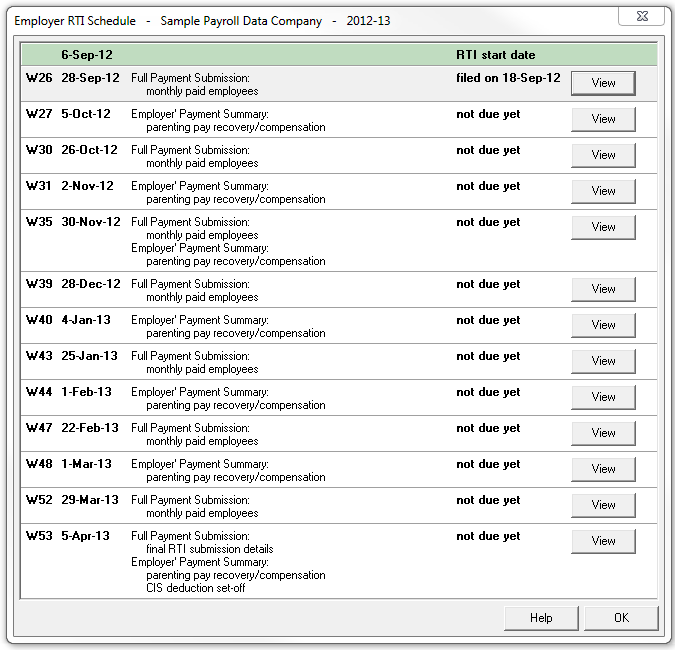

We have developed the 'Employer RTI Schedule' screen (below) in our Payroll software to manage the RTI submissions for each employer and to make this process as simple and efficient as possible.

The Employer RTI Schedule allows you to see which submissions are due (FPS, EPS etc.), when each submission is due, and summarises the information that each RTI submission will contain (e.g. starter and leaver details, sick pay recovery etc.). Payroll Manager automatically determines which RTI submission types are required for any particular period and allows you to send them at the click of a button.

(Please note: The Employer RTI Schedule screen will become visible in your software from the date that you join RTI.)

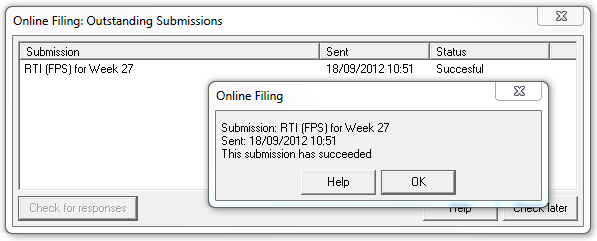

Clicking 'File Online' allows you to view the full details of each submission before sending your return to HMRC.

The RTI submission is then logged as having being sent, and a copy is stored for future reference.

What do I need to do now?

Some volunteer employers and agents have already begun to send RTI returns as part of the HMRC pilot scheme, which started in April 2012. Others have volunteered to join the scheme as 'early adopters', in November or December 2012. (If you have already applied to join the pilot in November / December this year then HMRC will be in touch with you in due course to confirm your joining date. Moneysoft will also be contacting you via email with instructions about sending your first submission). Applications have now closed for participating in the November / December pilot.

The vast majority of UK employers will continue to follow the existing PAYE procedures until joining RTI in April 2013.

There are a number of things that all Payroll Manager users can do now in order to help make the transition to RTI a smooth one. Make sure that your Payroll Manager program is up to date by clicking 'Help - Program Update' from the main menu - you will then be able to access the following features:

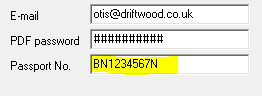

- We have added an RTI validation feature in the latest update to our Payroll Manager software. Clicking on 'Analysis - Data Validation for RTI' will produce a report giving details of any items that may be missing, and therefore cause an RTI return to be rejected by HMRC (highlighting missing dates of birth, NI numbers etc.). Running this report now gives you plenty of time to gather / input any information that you currently don't hold in the system. Please note that the data validation criteria for RTI is very similar to that for P35 /P14 submissions, so if you have previously submitted returns online using our software you should find that your data is already more or less complete.

- One item of data that was not required for P35 returns but will be required under RTI is the employer Accounts Office Reference. You can check that you have this entered in Payroll Manager by clicking 'Employer-Employer Details-Tax Office'. HMRC provide guidance on how to find your Accounts Office Reference on their web page How to find your Accounts Office Reference.

- It is also worth checking that the data you currently do have on file is correct and complete - e.g. when adding John Smith to the system, did you type 'J Smith', 'John Smith' or perhaps 'John Smythe'?. HMRC have published various documents about the importance of getting this information correct - see Why Employee Information Matters.

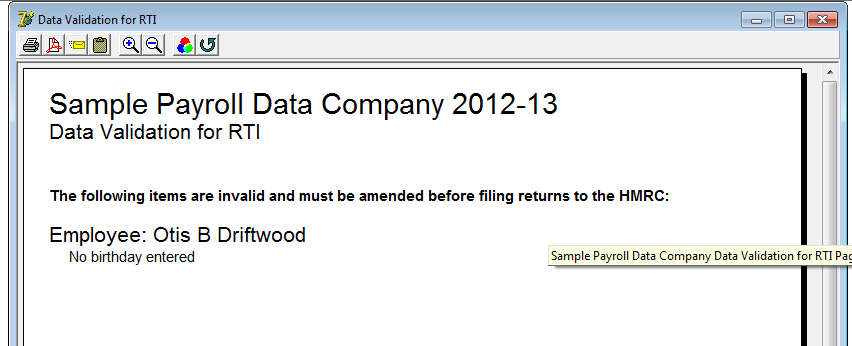

- To help with this, we have added a new layout of the Employee List report (click 'Employees-Employee List' and choose the 'Table' layout). Employers can use this report to check that they have the correct basic details entered for each employee (name, address, NI number etc.), whilst agents could send a copy of this report to their clients for completion / verification if they so wish.

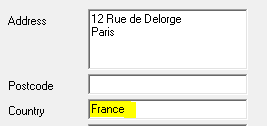

- HMRC have introduced a number of 'extra data fields' to be reported under RTI. Clicking on 'Employees - Employee Details' shows 3 of these new fields.

- 'Country' is an optional field - to be completed for employees living abroad, and is only required when an employee has no entry in the 'postcode' field

- 'Passport Number' is an optional field. If you obtain an employee's passport number as part of your recruitment process then you can choose if you wish to submit this to HMRC when sending your RTI returns.

- Clicking on the 'Work' tab at the top of the 'Employee Details' screen shows the new 'Hours worked' field, which is mandatory, and is sent with all FPS submissions. HMRC ask for you to choose from one of the following bands when reporting how many hours an employee would normally work in a week: 'Up to 15.99 hrs', '16 to 29.99 hours', '30 hrs or more', or 'Other'. Payroll Manager sets this field to 'Other' for all employees by default, so you may decide to take some time in setting this field accurately for each employee before sending you first RTI return.

What if I'm an agent / accountant - will there be an extra features to help me manage RTI?

We are working on an 'Agent RTI schedule' facility designed to help manage the RTI submission workload for those processing payroll for a number of clients. This is currently under development and will be available to all agents when RTI becomes mandatory from April 2013.

The new Employee List layout detailed above (click 'Employee-Employee List' and then choose the 'Table' layout) can be printed or emailed to clients to verify that the basic information you hold about their employees is correct.

Frequently Asked Questions

Once I have joined RTI will I still need to file P35s and P14s? - The majority of employers will join RTI in April 2013, and so will need to file their P35/P14s as normal for the year 2012-13 before moving onto RTI. Employers that join RTI early (before April 2013) as part of the HMRC pilot scheme will not be required to file a P35/P14 for 2012-13.

What about the P45 and P46 for joiners and leavers? - Once an employer has joined RTI they will no longer submit P45 or P46 forms for starters and leavers, as this information is automatically sent as part of the FPS submission. Employers will still need to issue paper copy of the P45 (a 'leaver statement') when an employee leaves, and this can be printed onto plain A4 paper by Payroll Manager.

When will I start sending RTI submissions? - The vast majority of employers will start filing RTI returns in April 2013. HMRC will be in touch with each company to inform them of their particular join date. Those employers / agents who have applied to be part of the RTI pilot scheme will be contacted individually by HMRC in advance of their joining dates, which will be in November / December 2012.

Will I need new software - No - Moneysoft Payroll Manager will be updated to provide all of the features and functions needed to file RTI submissions. Many of these features already exist in the current program but are 'hidden' from those not currently part of the RTI pilot scheme. These features will become active in your software in time for your RTI joining date.

Do I still need to give my employees a P60 at the end of the year? - Yes. Although RTI replaces the need for end of year filing to HMRC of P35 and P14 reports, it will still be necessary to issue each employee with a P60 at year-end. Payroll Manager is able to print these reports for you.

What about the Employers Alignment Submission (EAS) - does Payroll Manager send this type of return? - The Employers Alignment Submission (EAS) is a separate submission type used by 'large' employers (those with 250 employees or more) to 'align' their data with HMRC before submitting their first FPS. An EAS is not required for employers with less than 250 employees (and so is not sent by Payroll Manager ) as the 'alignment' data is these cases is included in the first FPS submission. (Note: We will add the facility to submit an EAS for the small handful of our users that have more than 250 employees.)

What happens if I make a mistake? - If you make a change to a pay period after you have submitted the RTI return for that period (e.g. because you needed to correct a mistake in the payroll), then you do not need to re-submit the return. Because the RTI return contains year-to-date totals, the error will be corrected when you submit the return for the next pay period in the normal way.

I have heard about a 'Bacs Hash Tag' - what is this and do I need to send it? - The small minority of UK employers that pay their employees using either Direct Bacs software or via a Bacs Bureau, will need to generate a 'hash tag' for each employee as part of the FPS submission. (The vast majority of employers do not pay their employees this way, for example those using Bank Transfer, Internet Banking, cheque or cash.) Payroll Manager can be set to automatically generate this 'hash tag' for employees that are paid via Direct Bacs software or via a Bacs Bureau. The hash tag is used by HMRC to cross-reference the FPS submission with the corresponding Direct Bacs payment submission.

What about expenses and benefits - P11d? - Nothing is changing with regards to expenses and benefits - so you will still be required to file a P11d as before if one is due for an employee.

If you have any questions about how Payroll Manager will handle RTI, or have feedback or suggestions about the information on this page, then please feel free to email us at [email protected] or call us on 08456 444 555.