Moneysoft Payroll Manager - Real Time Information ( RTI ) - Instructions for Pilot Volunteers

Thank you for volunteering to take part in the March 2013 stage of the HMRC RTI pilot. Moneysoft has been involved in the RTI pilot since the early stages in April 2012, and we already have over 650 users successfully submitting RTI returns to HMRC. A further 500 or so of our users are joining at this stage before the vast majority come on board in April 2013.

Joining RTI at the pilot stage allows you to get to grips with how the system works before it becomes mandatory in April 2013. It also allows us to test the 'usefulness' of our software and online support systems so that we can fine-tune things in readiness for April 2013. This guide is designed to take you through the whole process, from 'activating' the RTI features within the software right through to submitting your first RTI return. We ask that you follow the procedures outlined below, and submit your first RTI return at the relevant time, before letting us know your thoughts (if you wish) by email. (Of course, if you really do get stuck at any point then please do email / call us with your queries ).

When does the pilot begin ?

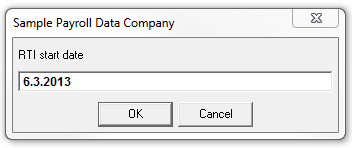

By now you may have (or should soon be receiving) a letter / email from HMRC confirming your participation in the RTI pilot. (Please be aware that if you are an agent filing on behalf of your clients then it is your client that will be receiving the correspondance from HMRC rather than yourself).This letter refers to what Moneysoft is calling your 'RTI Start Date', which for March volunteers is 06/03/2013. You will need to enter this date into the program (see later) in order to 'activate' the RTI features.

Your RTI Start Date determines the date from which you should start submitting your RTI returns i.e. you should send your first RTI return on the first pay date after this RTI Start Date, and continue to do so for every pay date in the future. e.g if your employees are paid monthly on 30th of the month, then you should file your first FPS on or before 30th March 2013. If your employees are paid weekly on a Friday, then your first RTI submission would be sent on Friday 8th March 2013.

How does RTI differ from the current system ?

Under RTI employers will still calculate Tax, NIC etc. in the normal way - it is just the reporting of these items that will change. Currently an employer is required to file an 'Employers Statement' (the P35) and associated 'End of Year Summaries' (the P14s) at the end of each tax year. Under RTI, these submissions will be replaced by new submission types (detailed below), which are sent every time that an employer pays their employees. Online filing of P45 and P46 forms also becomes a thing of the past, as details of new starters and leavers is sent together with the payment information. This means that you will not be filing an end-of-year P35/P14 return for 2012-13. (But you are still required to issue each employee with a P60 at year-end).

What information will I be sending in RTI ?

There are a number of different submission types that make up RTI filing. The 'main' types are the 'Full Payment Submission' (FPS) and the 'Employer Payment Summary' (EPS). Payroll Manager is able to determine which submission types are due at any particular point in time, and manages the submission of these returns via the 'Employers RTI Schedule' screen (details of which follow later in this guide).

Full Payment Submission (FPS)

- The FPS is the 'main' submission type, and is sent each time that an employer pays their employees. So if employees are paid monthly you send 12 FPS submissions per year, if employees are paid weekly you send 52 FPS submissions and so on.

- The FPS contains details of all employees that are being paid in that particular pay period, and includes details such as their tax code, gross pay, tax deducted, NIC, sick pay (SSP), student loans and parenting pay (SMP, OSPP, ASPP etc.) together with their year-to-date figures.

- Each FPS also contains details of employees that have joined or left since the previous pay period, which means that P45s and P46s are no longer sent to HMRC. (A paper copy of the leaving P45 should still be issued to the employee themselves).

- The first FPS that an employer sends when joining RTI also serves as what is called the 'alignment' submission, and contains details of all employees that have been with the employer since the start of the tax year, regardless of whether or not they have been paid, or have since ceased their employment. This alignment process allows HMRC to verify that they have the correct details held on file for each employee (e.g. National Insurance Number, date of birth etc.)

Employer Payment Summary (EPS)

- If during any one PAYE month an employer has statutory payments to recover (e.g. Sick Pay, Maternity pay etc.), or has suffered any CIS deductions, or has not paid anyone during this period, then this information is reported to HMRC via the Employer Payment Summary (EPS) submission.

- Moneysoft Payroll Manager is able to determine whether or not an EPS is due, and automatically prompts you to send it alongside the relevant FPS submission.

(There is also something called an Employer Alignment Submission (EAS) which you may see mentioned in various HMRC literature. The EAS offers an alternative way to 'align' your data with HMRC when joining RTI, and must be sent by employers with 250+ employees. This is not relevant to Moneysoft users with less than 250 employees as the 'alignment' data is sent as part of the first FPS submission (above), so please ignore the parts of the HMRC guidance /letter that refer to an EAS).

Getting ready - what you can do now

1) - The first thing to do is to make sure you have the latest version of Payroll Manager installed on your computer. Click 'Help - Program Update' from the main menu, and update your program if necessary.

2) - Make sure that you have the correct 2012-13 payroll data file open, and then click 'Pay - Pay Details' from the main menu at the top of the screen. ( Note: if you are using the software for the first time and have not yet created a data file, then please consult the 'Quick Start Guide' from the 'Help' menu in the program before proceeding further.)

3) - Activate the RTI features:- To do this click 'Employer-Employer Details' from the main menu in Payroll Manager, and then on your keyboard, hold down the 'CTRL' and 'ALT' and 'R' keys together. A box will appear (below):

Enter your 'RTI start date' into the box, and click 'OK'. You will then be taken through a series of three further screens. DO NOT make entires into any of these screens, instead simply click 'OK' on each of them. The software RTI features are now 'activated' for this employer. ( Please note: if you are operating the payroll for more than one company then you will need to 'activate' the RTI features in the same way for each employer that you are filing for.)

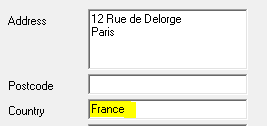

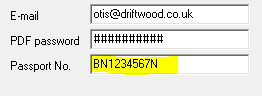

4) - HMRC have introduced a number of 'extra data fields' to be reported under RTI. Some of these fields are optional, and in practice will rarely be used. Others are mandatory, so it is worth spending a little time ensuring that you have the correct details entered. Clicking on 'Employees - Employee Details' shows 3 of these new fields.

- 'Country' is an optional field - it is to be completed for employees living abroad, and is only required when an employee has no entry in the 'postcode' field

- 'Passport Number' is an optional field. If you obtain an employee's passport number as part of your recruitment process then you can choose if you wish to submit this to HMRC when sending your RTI returns.

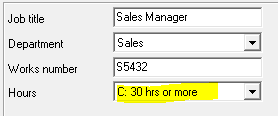

- Clicking on the 'Work' tab at the top of the 'Employee Details' screen shows the new 'Hours worked' field, which is mandatory, and is sent with all FPS submissions. HMRC ask for you to choose from one of the following bands when reporting how many hours

an employee would normally work in a week: 'A: Up to 15.99 hrs', 'B: 16 to 29.99 hours', 'C: 30 hrs or more', or 'D: Other'.

Payroll Manager sets this field to 'D: Other' for all employees by default, so you may decide to take some time in setting this field accurately for each employee before sending you first RTI return.

HMRCs guidance on completing this field states..."Enter how many hours the employee normally expects to work in a week. If the employee is on paid leave, for example annual leave or sick leave, report the normal hours worked. If you consider 'A', 'B' or 'C' are not appropriate then indicate 'D' "

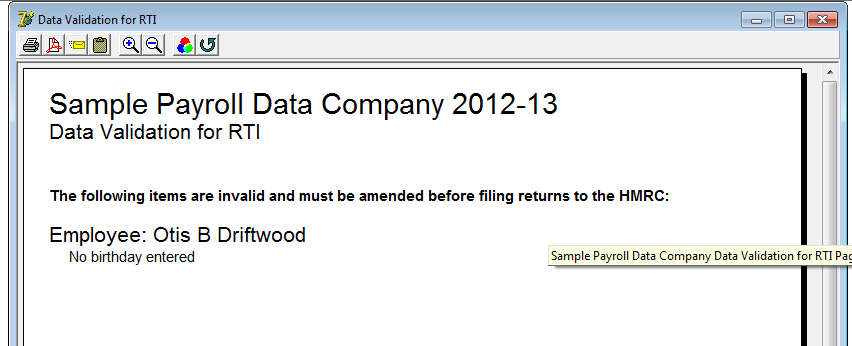

5) - Check that your data is valid and complete: We have added an RTI validation feature into Payroll Manager which will allow you to check in advance the validity of your data with respect to HMRC's RTI filing rules. Click 'Analysis - Data Validation for RTI' from the main menu at the top of the screen. This report flags-up any missing or invalid data items which you can then correct. Once your data is complete the report will indicate a successful validation.

What to do before your RTI start date

Once you have reached your 'RTI Start Date' you will no longer be required / able to file P45 / P46 starter and leaver forms online to HMRC, as this information will be included as part of your FPS submissions. Because of this you must ensure that P45 / P46 forms for anyone joining or leaving before the RTI start date have already been filed with HMRC. Please be aware that it will still be necessary to issue all leavers with a paper copy of their P45 under RTI (which you can print onto plain paper form Payroll Manager), even though you will not be sending the P45 to HMRC.

Step by step instructions for sending your first RTI submission

Once you have finished entering the pay details for all employees then you are ready to send your first RTI submission.

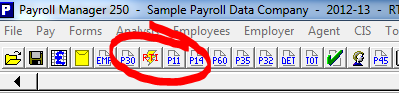

1) Click on the ![]() button on the main toolbar

button on the main toolbar

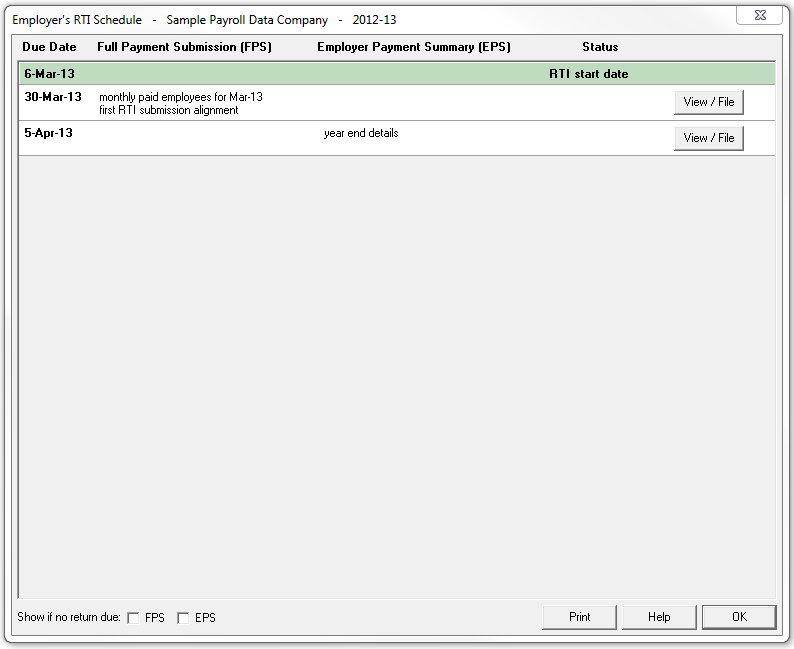

2) You will then see the Employer's RTI Schedule. The first pay period on or after your RTI start date will now show as being 'due'. Click the 'File Online' button.

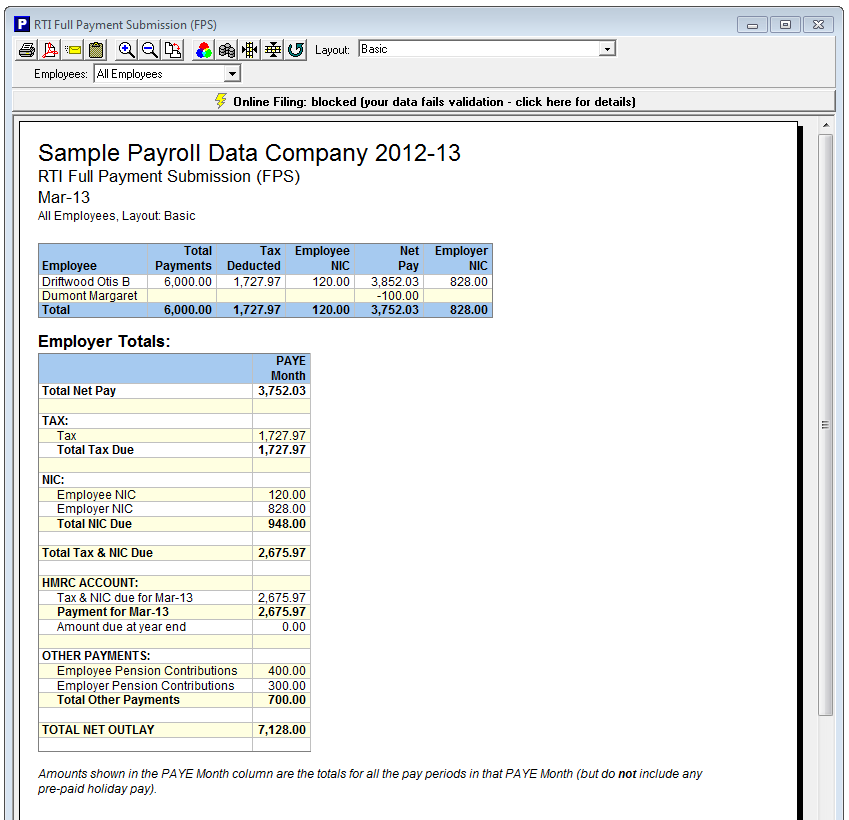

3) You will see the Employers RTI Summary for that period, which gives details of who is being paid in that particular pay period. At the top of the report you will see the words 'Click her to file this return online'. (If the text says 'online filing blocked (your data fails validation - click here for details)'- then click for details and fill in missing data) , otherwise click 'Click here to file this return online'.

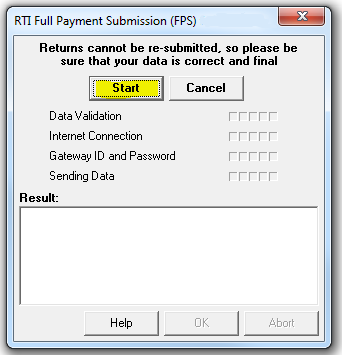

4) Sending the submission: - The following window will appear - Click 'Start' to file the FPS.

Your submission will then be sent to HMRC. The screen will then indicate that your submission has been sent to HMRC. Click 'OK'

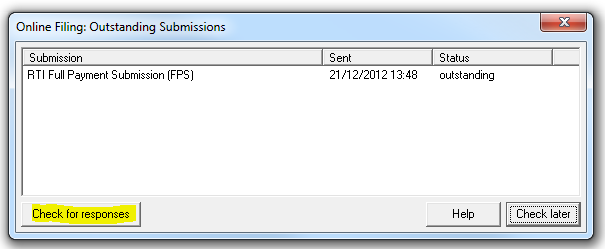

5) Receiving your response: - Once your submission(s) have been sent, you will see the following screen...

The 'outstanding' status indicates that the submission(s) has been received by the Government Gateway. Click 'Check for responses' to view the HMRC response.

(Note: Normally you can expect HMRC to respond within a matter of seconds. However, under certain circumstances (e.g. busy periods, system maintenance etc..) HMRC may take a number of days to respond. In such cases you can choose to 'Check later', and then come back to the program and check for responses at any time during the next 30 days.)

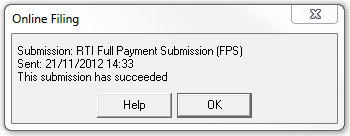

Once HMRC have responded to your return you will see the following message..

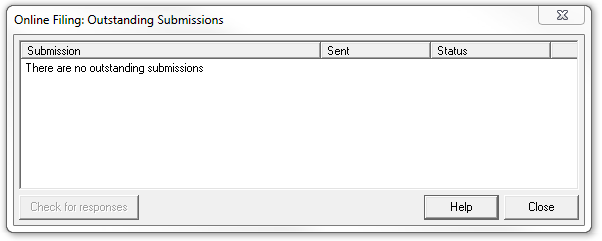

Click 'OK' and the screen will show that there are no outstanding submissions. Click 'Close'.

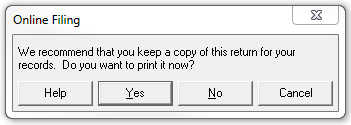

and you will be asked if you want to print a copy for your records.

.. and that's it - you have successfully filed your first RTI return!

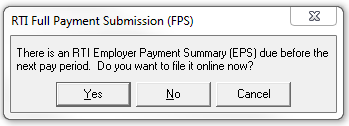

In some circumstances (e.g. you have SSP or SMP recovery to claim) then an 'EPS' submission may also be due. If this is the case then Payroll Manager will display the following message..

You can either choose 'Yes' to file the EPS immediately, or return to the program at a later point and file the return then.

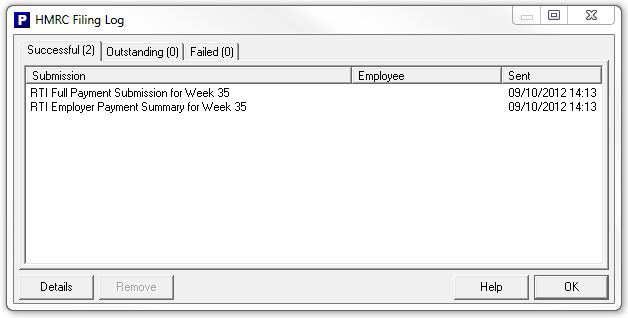

If you should ever wish to see a historical record of the RTI submissions that you have sent, then click 'Tools - Online Filing - HMRC filing log' to display a list of all submissions sent in the current tax year.

We hope that you found this guide useful and easy to follow. We would appreciate your feedback via email if possible to [email protected]. If you have any suggestions as to how we could improve this guide, the RTI filing process, or Payroll Manager in general then these will be gratefully received. Thank you.